Texas Homeowners, 🤠

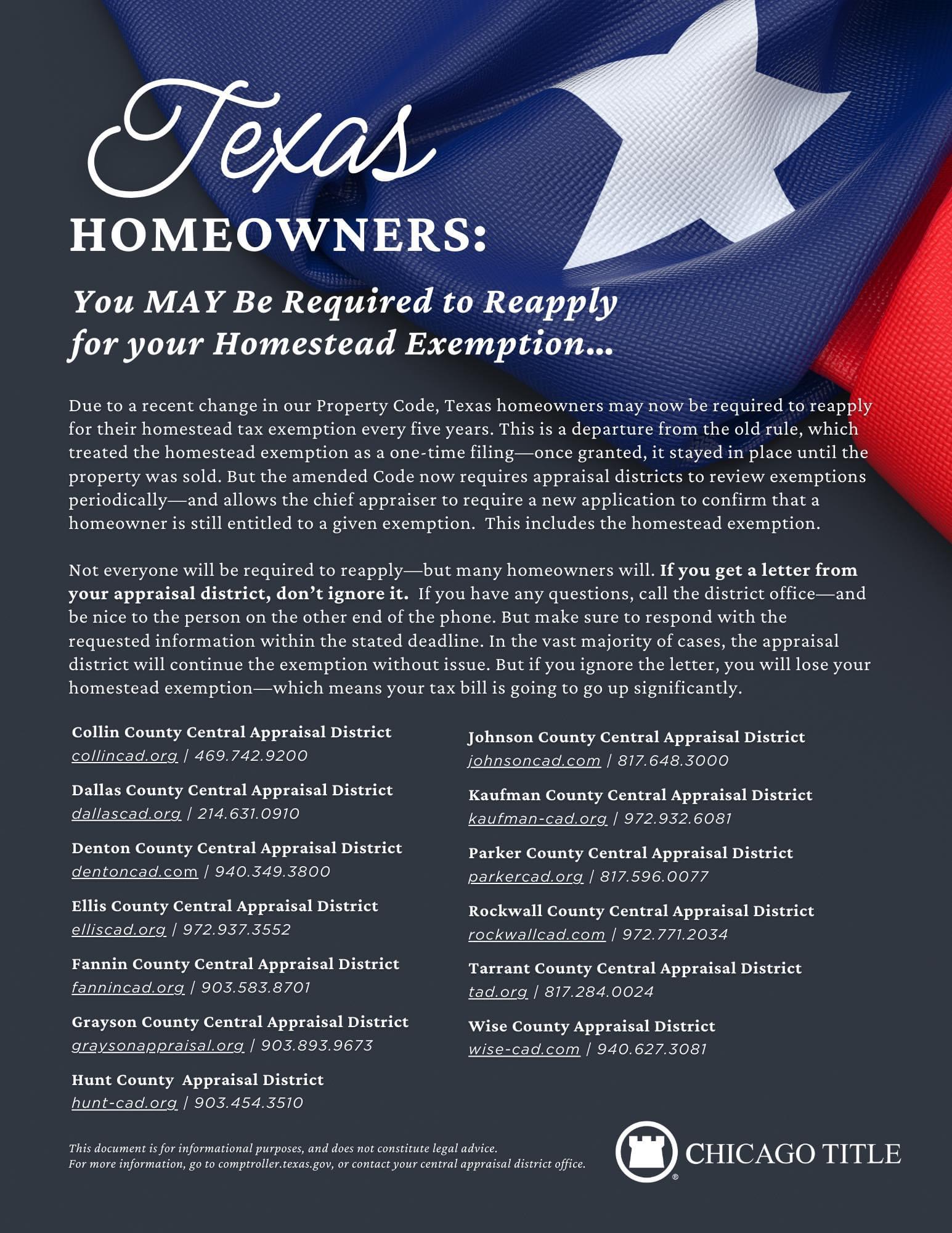

Some of you may have received a notice in the mail recently regarding re-filing 📄 for your homestead exemption. Due to a recent change in our Property Code, Texas homeowners may now be required to reapply for their homestead tax exemption every 5️⃣ years. This is a departure from the old rule, which treated the homestead exemption as a one-time filing—once granted, it stayed in place until the property was sold. But the amended Code now requires appraisal districts to review exemptions periodically—and allows the chief appraiser to require a new application to confirm that a homeowner is still entitled to a given exemption. This includes the homestead exemption.

This document is for informational purposes, and does not constitute legal advice. For more information, go to comptroller.texas.gov, or contact your central appraisal district office.